Notes from the edge of civilization: June 22, 2025

Debt and demise. That is all.

According to the US Debt Clock, the national debt has crossed the $37 trillion mark. Treasury data indicates an increase of $48,710.63 per second. In the time it took you to read those sentences, we just added about half a million dollars to the national debt.

The Federal Reserve Bank of New York’s latest data shows total household debt climbed to a record $18.2 trillion in the first quarter of 2025. While credit card and auto loan balances dipped slightly, student loan debt spiked by $16 billion to $1.63 trillion.

Redfin reports the median home-sale price hit an all-time high of $396,500 during the four weeks ending June 15. Since 2020, home prices have risen over 45%.

And that’s not even the bad news.

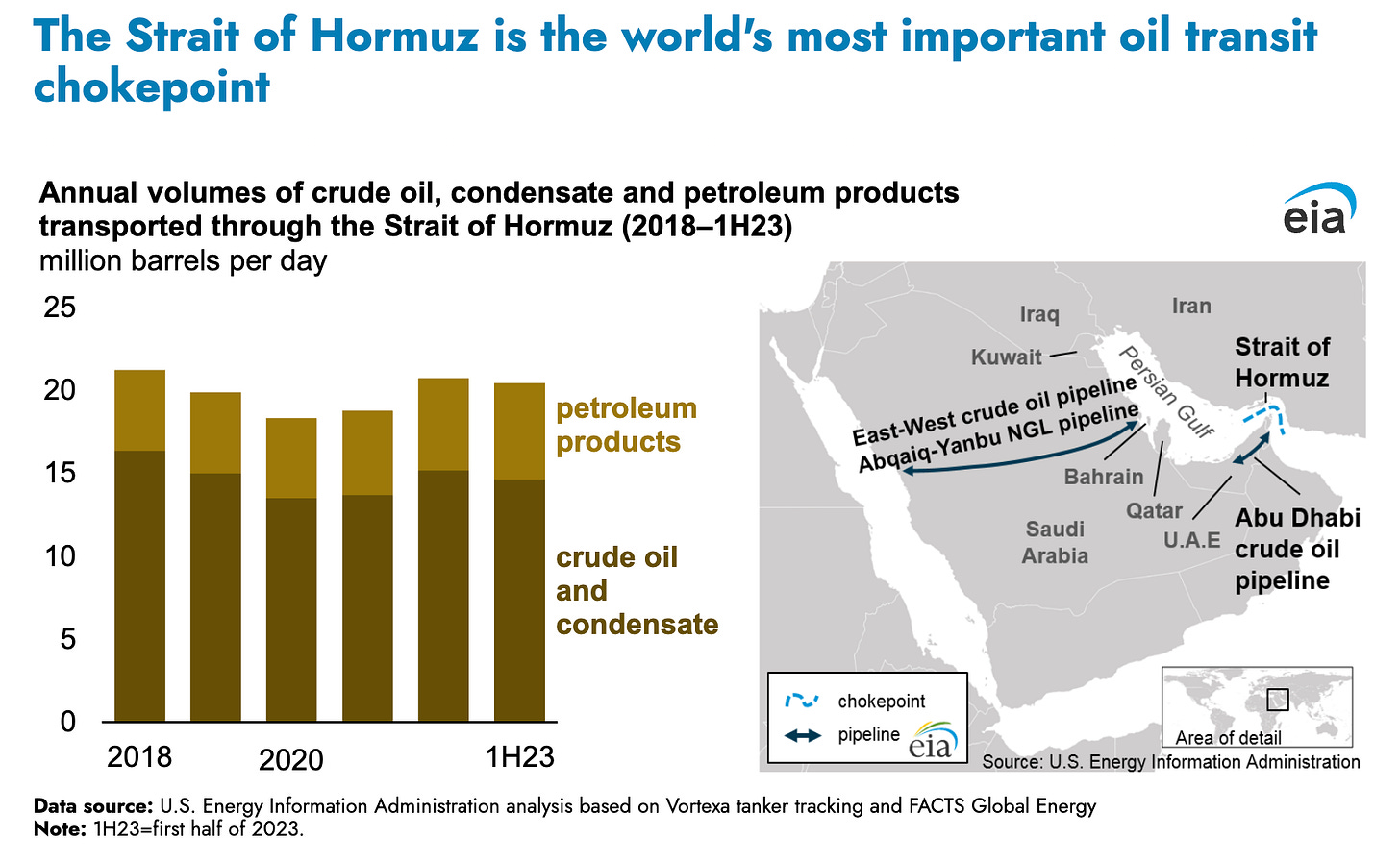

War in Iran is undoubtedly going to cause oil prices to spike. Iran’s parliament just voted to close the Strait of Hormuz, an essential transit point for oil from the Middle East to reach Europe and North America. We can only surmise the US will not look favorably upon this decision (duh!).

Reuters reports investors are bracing for a knee-jerk reaction in global markets when they reopen tomorrow morning.

In the immediate aftermath of the announcement, [investors] expected the U.S. involvement was likely to cause a selloff in equities and a possible bid for the dollar and other safe-haven assets when trading begins, but also said much uncertainty about the course of the conflict remained.

You’ll probably be paying more for everything starting tomorrow. But you’re a Collapse Life reader, so you’ve been preparing for this. Right?

Welcome to the new normal, where nothing is normal.

*****

We wanted to give you some bonus information to think about, given that the actions undertaken by the President yesterday will require an enormous amount of persuasion incentive to convince other countries to buy US debt to keep this charade going.

For starters: Trust? We don’t need no stinkin’ trust. Whatever remaining goodwill and integrity the US may have had among peers in the international community, that’s very likely gone, much like a ‘Bunker Buster’ bomb into a mountain.

US dollar demise: our currency is the best of the worst out there. That’s only because King Dollar has dominated the monetary system for a long, long time — other countries are forced to use the US dollar for international settlements. But the dollar has also been foolishly weaponized by our leaders for quite some time — think sanctions, and SWIFT bans for starters. Many will claim rumors of the dollar’s demise have been greatly exaggerated. And yet, we don’t think this past weekend’s events help the case for dollar dominance in the least. In fact, we think the possibility exists that de-dollarization will become turbocharged now, in a way that we have not witnessed. If you think the dollar is backed by the “full faith and credit of the US government,” you haven’t read this article closely. Read it again.

Peace is priceless. For everything else, there’s Mastercard. Sadly, not even Mastercard has credit limits high enough for what we just witnessed. Collapse Life turned to Grok for a quick-and-dirty computation of what this past weekend might have cost based on what we know. It’s not pretty. Take it with a grain of salt, as Grok has to use publicly available information, but the costs of this one sortie won’t help our debt situation. It doesn’t even account for our nation’s topping up of Israel’s Iron Dome defenses. If this continues, costs will mount and that’s not good:

Total GBU-57 (a.k.a. ‘Bunker Buster‘ bombs) Cost: 14 bombs×$4,100,000 per bomb=$57,400,000

Total Cost of B-2 Spirit Flights and Support aircraft: $18,900,000 (B-2s)+$7,200,000 (tankers)+$8,000,000 (fighters)= $34,100,000

Total Tomahawk and Submarine Costs: $52,500,000 (missiles)+$1,000,000 (submarine)=$53,500,000

Total Additional military support costs: $91,000,000 (Nimitz, Vinson Carrier Strike Groups)+$35,000,000 (destroyers)+$80,000,000 (fighters)+$12,000,000 (logistics)+$10,000,000 (other)=$228,000,000

So yeah. Happy Sunday.

(While we were finalizing this, our friend John Rubino chimed in with an update worth adding: Back to the 1970s! If bellbottoms and disco make a comeback, we know we’re past the point of no return.)

Hey, if you’ve made it to this point and haven’t slit your wrists, GOOD. It’s not worth it. Live with purpose, like fellow Substacker Susan Harley, who was our guest on the Collapse Life podcast this weekend.

Well, at least we had Disco in the 1970's so we could dance away our doldrums....

I thought I unsubscribed from your vapid commentary…..