Notes from the edge of civilization: November 16, 2025

Madman at work; Bubble bubble, toil and trouble; and yes, it's sickening!

There’s simply no way to do this week’s roundup without a brief nod to our Madman… er, Commander in Chief. And let’s be clear: Collapse Life is an equal-opportunity critic. This isn’t red vs. blue, left vs. right — this is a critique of mental stability and basic decorum, two of the basic qualities one might hope for in the man running the world’s most powerful military.

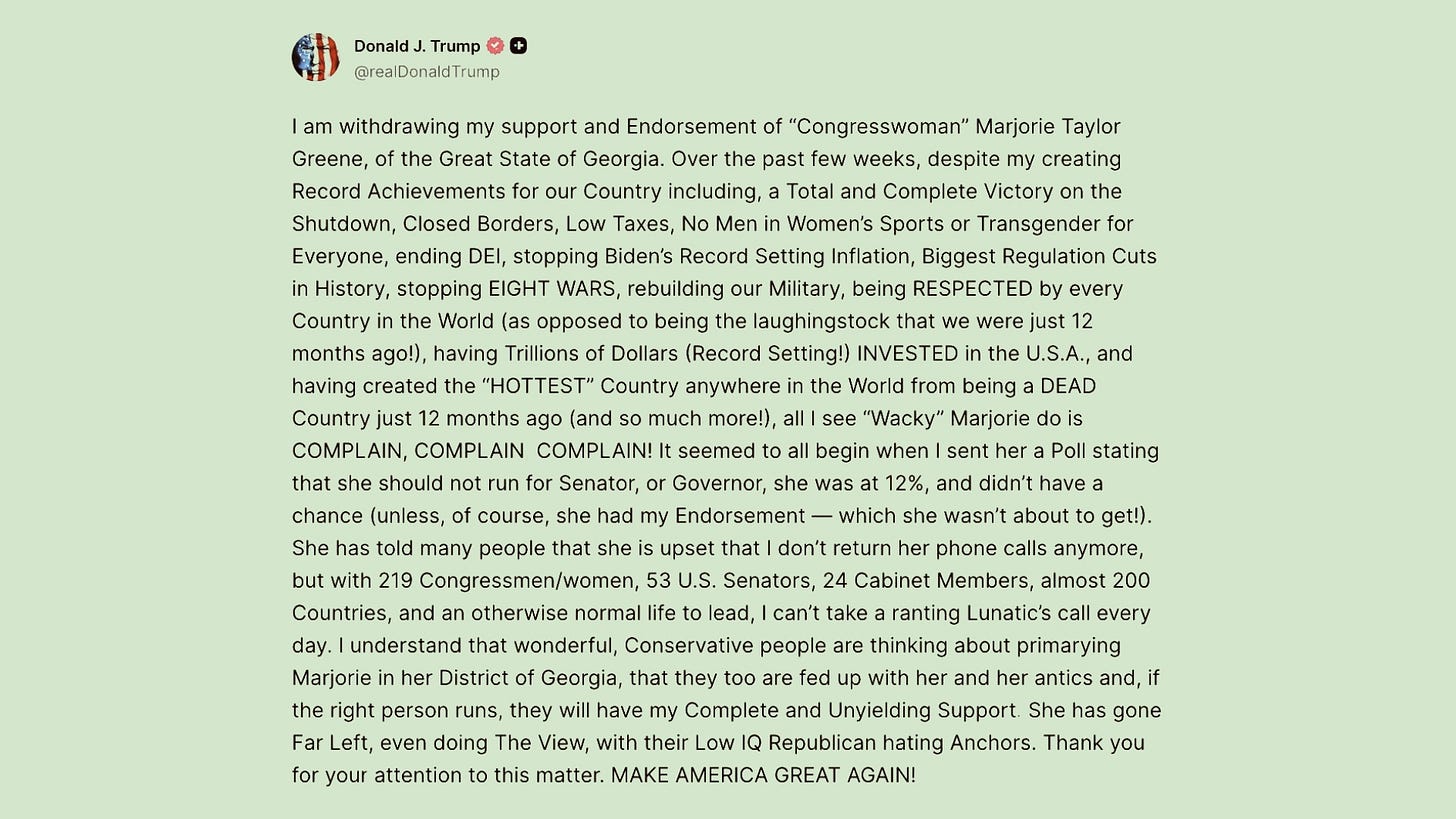

With all the various and sundry issues, problems, crises, and potential wars we are facing as a nation, somehow this President found time to jump on — in a most puerile fashion — congresswoman Marjorie Taylor Greene and congressman Thomas Massie.

Greene had her presidential endorsement yanked for the unpardonable sin of independent thought — signing a petition to force a vote compelling the DOJ to release all Epstein files in its possession. Massie, one of the four other Republicans who dared sign it, received a swipe over an intimate, personal choice.

We won’t belabor the story, which is perfectly summed up in the two posts above; but we will remind you, these words come from the same man with full access to the nuclear codes.

Suffice it to say, all roads lead to Epstein. Whoever and whatever is behind the Epstein operation must be incredibly powerful because when even the President of the United States genuflects to this dark clandestine force, you know something massive is at play.

So how do we end this quick vignette on the stupidity being displayed? Maybe: Arkancide incoming in 3…2…1… ? Maybe we say: Mind your own business, Mr. President? Do we say: Don’t be so sensitive when Americans boo you at a football game? Or is it simply: All of the above? What a time to be alive.

With so many problems facing our nation, shouldn’t our elected officials be panicking about the smoldering carcass of an economy in this country rather than worry about who’s marrying who?

The Big Short (2015) was a Hollywood movie following a group of contrarian bankers and hedge fund bros who foresaw the 2008 housing market collapse and bet against it, making massive amounts of money from the ensuing mayhem. The movie was a biting critique of how an entire economy was built on lies. At that time, the smartest man in the room was a medical doctor turned hedge fund manager named Michael Burry.

In late October, he tweeted this:

He’s closing down his fund, Scion Asset Management, and has indicated he’s returning capital to investors. He’s a contrarian investor to watch, to be sure. But the tweet, and his moves to decouple from the market madness at this juncture are certainly indicators that all is not right with the system.

Peter Grandich called what we’re seeing a K-shaped recovery, where the small percentage at the top continue to enjoy the privilege of being very close to the money-spigot of the US government. Meanwhile, the rest of us are feeling the impact of the incredible shrinking dollar.

Jesse Felder, of The Felder Report, called AI and its pervasive dominance of the markets and economy A Frankenstein of Financial Bubbles. We couldn’t agree more and whichever way you slice it, when this bubble pops, it’s gonna hurt!

(BTW, if you haven’t seen The Big Short, put it on your to-watch list. NOW!)

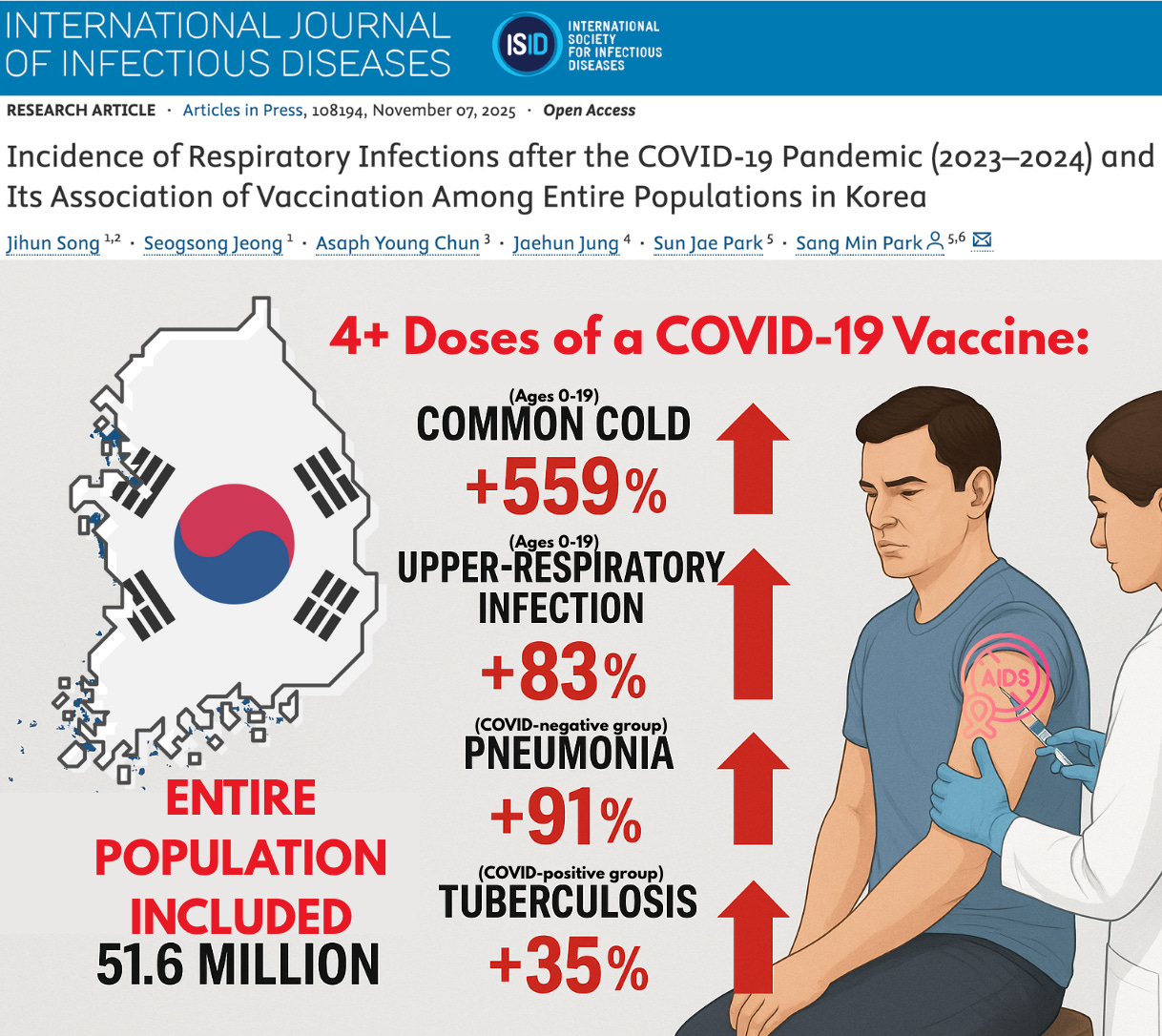

Although it’ll come as no surprise to our readers, this next piece is worth mentioning, especially since most of us still have to operate among the WWJ: that is, walking while jabbed. A major study of the entire South Korean population uncovers a VAIDS signal — a dose-dependent rise in the common cold, upper-respiratory infections, pneumonia, and tuberculosis among the vaccinated.

VAIDS stands for vaccine acquired immune deficiency syndrome and it’s a real thing. So to put it in a way people can understand, the more doses of the jab you got, the greater the incidence of additional illness. The graphic below sums it up better than any of our words can.

We have to acknowledge the tremendous work of Nicholas Hulscher (@nichulscher) of the Focal Points substack for bringing this study to our attention and for breaking down the study to show just how damaging the shots were.

But then, you already knew that.

Burry closing Scion is one of those canary-in-the-coal-mine moments that people will look back on. His timing during the 08 crisis was impecable, and now he's exiting at what looks like peak euphoria. The AI bubble comparison to Frankenstein is spot on too, we're stitching together massive valuations based on projections that may never materialize. When this unwinds, the contagion risk feels way higher than 08 becuse everything is so interconnected now.

Like in the time of King Antiochus Epiphanes?