Easing as a way of appeasing

Somehow, the election flipped a switch. Where there was once dread, there is now elation. Happy days here again! Or, did we (once again) kick the can down the road?

The story of Yossi Levi, founder of Car Dealership Guy, is remarkable on so many levels. Within a short period of time after launching his X (Twitter) account in December 2021, both Cathie Wood — of the famous ARK Invest — and Elon Musk retweeted some of his insights, launching him into the stratosphere of influencers and commentators on X, with a specific focus on (in case we need to state the obvious) the automotive industry.

Each week, Levi curates the top five automotive industry headlines based on topics his readers engaged with the most on social media. Coming in at number two in his email update of November 12 was this interesting tidbit:

Auto lenders are easing up after a summer of tightening. The Dealertrack All-Loans Index rose 2.2% from Sept. to Oct., the largest month-over-month increase in credit access since March 2022.

Credit unions led the loosening, while auto-focused finance companies offered the most access compared to pre-pandemic levels.

And subprime loans saw a notable boost, with approval rates up 1.2% year-over-year.

Meanwhile, certified pre-owned loans saw the biggest loosening, while credit for used car loans eased the least.

Other trends worked in consumers' favor, including narrowing yield spreads, shorter loan terms, steady down payments, and declining negative equity. Average auto loan rates have also fallen by 124 basis points since March.

Among the bullet points, the second one is notable, and specifically the word ‘subprime.’ You should remember this word from the 2008 Great Financial Crisis. And you should worry when you see it.

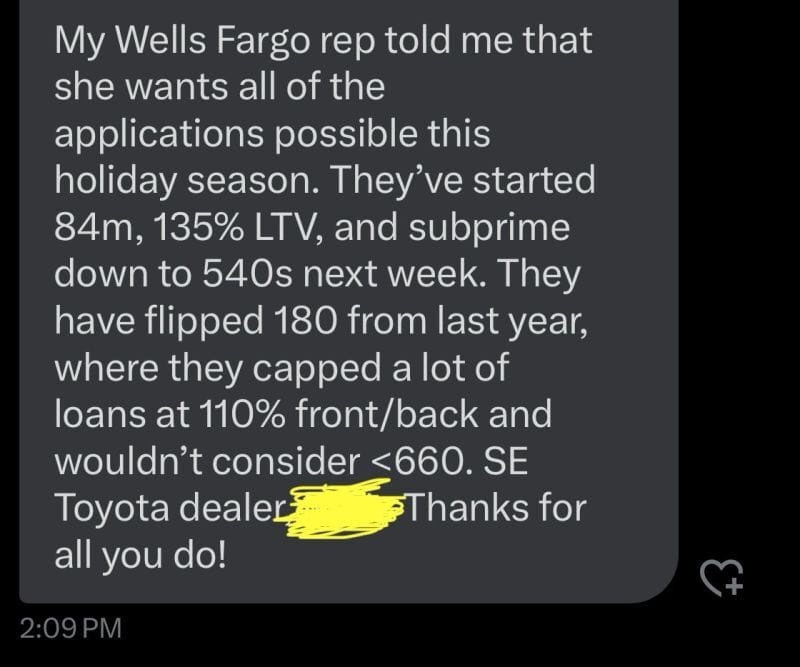

Levi included an interesting text message he received from one of his followers/subscribers, which confirmed that banks are going all in to juice the numbers before year end. While it is a somewhat technical text message, the headline was pretty clear: “They [the banks] have flipped 180° from last year,” the message reads.

Decoding the message looks something like this: 84m means 84-month loans, where LTV is loan-to-value, and “subprime down to 540s” is the customer credit rating acceptable as a cut-off for loan consideration. To break it down even more simply, essentially people with very poor credit scores are being offered seven-year, high risk loans on a depreciating asset.

If this in fact true, we have a very purposeful effort to entrap people who cannot actually afford to buy new cars and may likely default over the longer term. So then the intention is to make automotive consumer numbers look good in the short term — the equivalent of a jolt of caffeine or cocaine, helping to add yet another flimsy building in this Potemkin village of an economy.

Worse yet, Zerohedge just acknowledged that nearly 40 percent of cars financed since 2022 are underwater, which further suggests what we are witnessing is a very dangerous game of chicken with peoples’ finances and ultimately, their lives.

Then, just as we were writing this, a Charles Hugh Smith Substack article landed in our inbox. And sure enough, he recognized and articulated where this all ends more eloquently than anything we could write.

The top 10% (who think everything is wonderful) will never vote for substantial change, as they'll never vote for anything other than feel-good minor change…

I think Door #3 will be taken ... which the Deep State will have to allow as they see civil unrest coming ever clearer on the horizon if not. What is Door #3? A Crash of assets, which will flatten the divide. In a credit-based economy, it will be easy to let it all fall. Assets fall everywhere ... including debt (an asset for top 10%) as the bottom 90% just walk away (as there are no debtor prisons). A crash of assets requires no vote ... just The Powers That Be standing back. (Of course, half measures will be taken to show the top 10% were DOING SOMETHING ... but in reality this only stretches out the collapse).

What Smith outlined in this short paragraph describing “Door #3” is unlikely to come as a surprise to Collapse Life subscribers. After all, this Substack prides itself on ‘red pilled’ readers and sharing information from people who are chronically (painfully?) tethered to reality. Staring at these types of things is often ugly, but there’s no sugar coating it: we’re well past the ‘Best Before’ date on this can of whoop-ass.

If you want to see this graphically — as Smith envisions it potentially unfolding — the following should send shivers down your spine. And further, if this doesn’t come as a shock to you even with the full ‘red pill’ effect, the folks signing up for 84-month subprime car loans will be completely and utterly devastated by what is to come.

Not two weeks ago, we suggested that maybe Donald Trump’s second presidential victory was a distraction. Parenthetically, we hope the UFC appearances, while certainly entertaining, don’t become a sideshow to the very important work the President faces given the complex geopolitical situation he will inherit. At the risk of sounding like party-poopers, we’re all for entertainment when the hard work is done, but laying out a plan for massive social and governmental transformation is very different from actually executing that plan.

Without a distraction, a plan such as the one suggested by Charles Hugh Smith will be virtually impossible to pull off. That means the protests around the massive government layoffs that are coming, rising inflation once again, war and rumors of war, and the public meltdowns by wokesters and mainstream media morons are likely to all take pride of place on our screens. The question is: are you going to fall for it?

Not only are bad lending practices allowed, they are subsidized. We also have the best Legislature that money can buy. Investing in candidates has a huge return on investment.

As long as people continue to vote in politicians that do not represent their interests over lobbyists and donors, the problems will continue and probably increase. Why do you think that they are so damning of the idea of "populist" candidates? They only want people to elect politicians that are in on the game. In this, they are totally bipartisan.

I do believe a financial collapse is coming and to keep the whole fiat system going they need to digitize money. They want to convince people to accept a convenient CBDC, that is programmable. Trump and Bobby won't be saving us I'm afraid. One final kick of the can before.. Slavery. Bitcoin, Monero, gold and silver are being franticly embraced before the inevitable.