Money. For nothin’.

Visualizing the great shrinking dollar.

Thomas Jefferson was staunchly against central banks. The American Founding Father is often quoted as saying:

If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered.

On account of the use of words like ‘inflation’ and ‘deflation’, which were not in the lexicon of the time, the Jefferson quote is likely spurious, as indicated by the Thomas Jefferson Foundation.

Regardless of whether those were Jefferson’s actual words, the sentiment appears to be largely correct, having played out exactly as he purportedly predicted.

Since the founding of the Federal Reserve Bank in 1913 – which is about as Federal as Federal Express – this private banking cartel has had its hand on the lever of the dollar printing press and the United States economy. In that time, it has managed to successfully remove much of the purchasing power of the U.S. dollar.

Today, what you’re seeing and feeling when buying gas, groceries, and housing is all thanks to the remarkably shrinking dollar and its associated dwindling purchasing power. This process continues to erode with each passing year, compounded by excess money printing, global de-dollarization, a worsening national debt situation, a grim personal debt situation, and a flailing Federal Reserve that’s been largely asleep at the wheel.

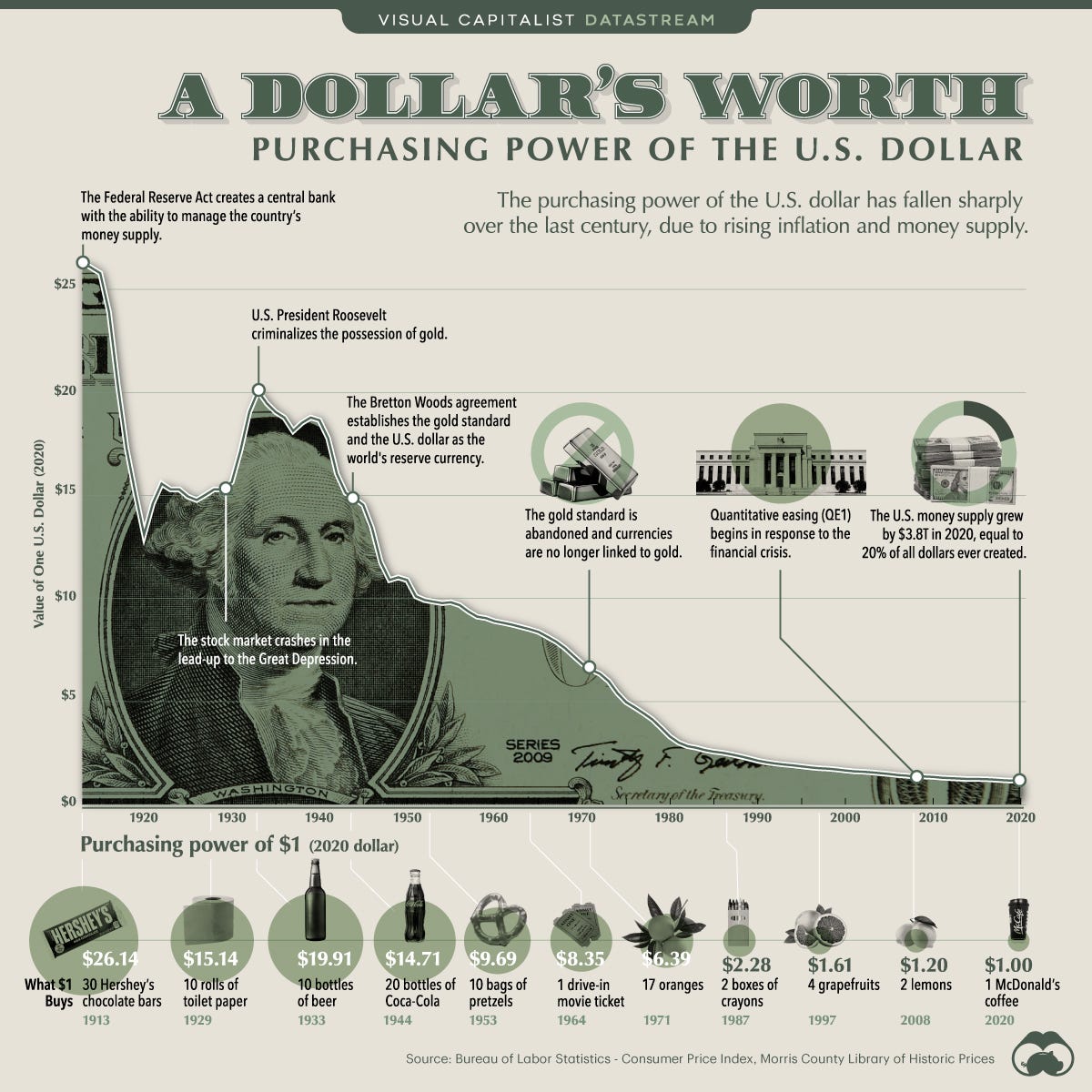

Visual Capitalist, an online publisher of data-driven visuals, published the following graphic on the great shrinking dollar back in 2021.

Between 1913 and 2021, the U.S. dollar lost about 96 percent of its purchasing power. In the two years since the graph was printed that loss has continued, making it probably closer to 98 percent by now.

What is purchasing power? Visual Capitalist explains:

The purchasing power of a currency is the amount of goods and services that can be bought with one unit of the currency.

For example, one U.S. dollar could buy 10 bottles of beer in 1933. Today, it’s the cost of a small McDonald’s coffee. In other words, the purchasing power of the dollar — its value in terms of what it can buy — has decreased over time as price levels have risen.

In 1913, when the Federal Reserve Act granted the Federal Reserve the ability to manage the money supply, one dollar could buy 30 Hershey’s chocolate bars. By 1929, a dollar could only get you 10 rolls of toilet paper.

Between the end of the Korean War in 1953 and the escalation of the Vietnam War in 1964, the dollar lost even more purchasing power: $1 got you 10 bags of pretzels in ‘53 and only one drive-in movie ticket by ‘64.

Fast forward to the Global Financial Crisis of 2008 and you’d only get 2 lemons for your dollar.

These days, you’re lucky if it gets you a coffee at McDonald’s — and only if you use the phone app.

Money is a medium for exchange for goods and services, not a repository of wealth. There are economic advantages for it being unstable. It is both the fuel of the economy and the pressure relief valve.

People have the warped vision of wealth being Scrooge McDuck sitting in the vault on sacks of money. That is not the way it works. Money is only useful when it is being used. The instability is an incentive to not just stack it up. That benefits no one and stagnates the economy. The idea is to use it, either to buy goods and services or invest it.

In the most conservative investment, putting it in a savings account, it is still being used. You put the money in an account where it can be loaned out to people who want to buy things. The interest you get is payment for that investment. The risk that you take is minimal but the returns are minimal as well. The advantage is liquidity. You can take it out at a moment's notice with no penalty. Take a little more risk of missing opportunities to invest it elsewhere at a better rate of return, you can make a deal to leave it in for a longer period of time such as a CD, Bond, or a Treasury note for some fixed time period. You can invest in other assets such as a home, percentage of a business, your own business, or even other currencies or commodities.

Sure you can shuffle it around and make some money through arbitrage, but money is no more an investment than the banana I just ate or the bowl of pennies I have sitting on my desk.

Of course the investment medium you choose puts the onus on you to choose well. It puts more pressure on the people with few assets to protect their wealth but that is as true today as when Jesus said, "The poor you will always have with you” (Mk 14:7) I am sure that it goes back further than that. When people have a choice, there is no guarantee that they will make good ones.

Anytime you spend or invest money, you take the risk that you could have gotten more for the exchange. Anytime you don't spend money, there is the risk that you might not get as good of a deal next time an opportunity presents. Just sitting on it is a risk unto itself.